The transformation of Shark Tank investor Kevin O’Leary into a Tesla advocate is a fascinating narrative of shifting perspectives in the investment landscape. Prior to 2019, O’Leary was skeptical of companies that did not demonstrate immediate profitability. In fact, he candidly admitted in a CNBC Make It interview that if Elon Musk had presented Tesla during its nascent stages, he would have outright rejected the opportunity.

“If Elon Musk came into the Shark Tank and told me to invest in his electric car company before he started it, I would say, ‘You’re crazy.'”

O’Leary’s Investment Evolution: From Doubt to Support

By mid-2019, O’Leary’s viewpoint had evolved significantly, leading him to purchase Tesla stock that July. Just a few months later, by January 2020, Tesla’s market capitalization soared to an astonishing $100 billion, validating O’Leary’s investment decision.

Fast forward to February 2025, O’Leary proudly confirmed that he remained a shareholder in Tesla and expressed ongoing support for Musk’s strategic direction.

O’Leary’s initial doubts marked early 2019, where he declared Tesla as an overvalued entity struggling with fierce competition. However, a pivotal moment occurred later that year when his son, Trevor, secured an internship with Tesla.

“You don’t understand what Tesla is doing. I work there.”

Trevor’s insights provided a deeper understanding of Tesla’s operations and technology, particularly its impressive data-gathering capabilities. He elucidated how Tesla harnesses data from its entire fleet to build a vast database aimed at refining its autonomous driving technology. This discussion prompted O’Leary to delve into Tesla’s advancements in neural networks, showcasing how the company integrates information from extensive vehicle mileage to enhance navigational systems and driving automation.

In July 2019, O’Leary capitalized on his newfound knowledge by investing in Tesla shares, which at the time were trading in the $200 range. This investment paid off, as Tesla’s stock experienced a meteoric rise, prompting O’Leary to reflect positively on his decision.

Tesla’s Remarkable Growth and O’Leary’s Continued Backing

By January 2020, Tesla’s valuation escalated, surpassing $100 billion. This upward trend persisted throughout May 2020, where the company consistently maintained an average market cap above this benchmark.

“Am I a shareholder today in Tesla? Yes, I am,”O’Leary affirmed in a CNBC segment, highlighting Tesla as his top-performing investment.

In a more recent Fox News interview, O’Leary reiterated his support for Musk, especially regarding fiscal policies aimed at scrutinizing government expenditure. He emphasized the necessity of applying standard budgetary reviews at the governmental level, drawing interesting parallels between basic financial management and large-scale economic strategies.

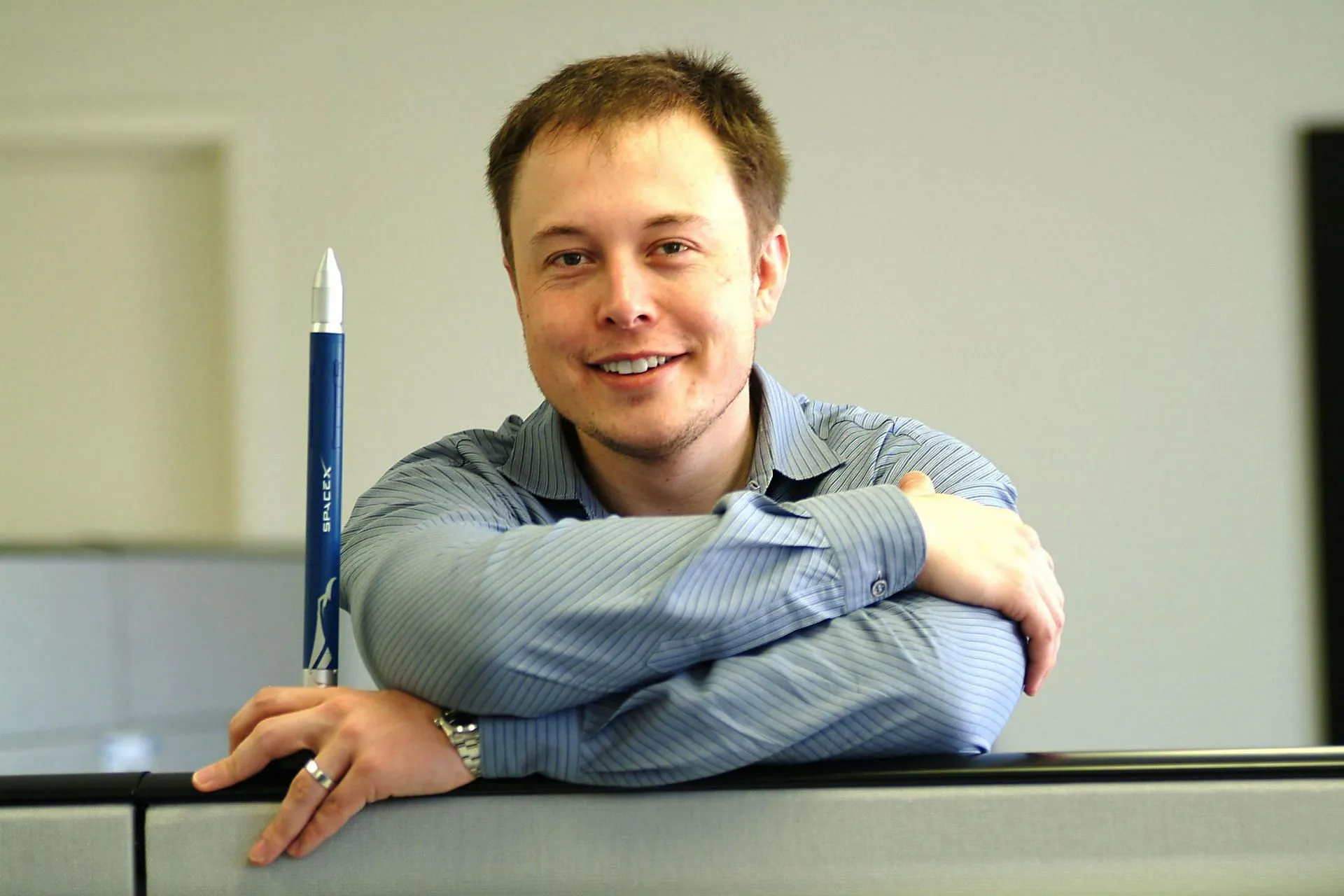

The Tesla Journey: Elon Musk’s Vision

Tesla’s narrative began in 2001 when founders Martin Eberhard and Marc Tarpenning crossed paths with Elon Musk at a Mars Society gathering. Initially preoccupied with PayPal and SpaceX, Musk’s focus shifted when he received a significant financial gain from eBay’s acquisition of PayPal in 2002.

In 2004, he spearheaded Tesla’s inaugural investment round and assumed the role of board chairman. Tesla operated from a 5.3 million-square-foot facility in Fremont, California, previously utilized by Toyota and General Motors, which featured an extensive assembly line.

By 2008, under Musk’s leadership, Tesla debuted its first vehicle, the Roadster, which redefined the public perception of electric vehicles by proving they could be both high-performance and exciting. Over the years, Tesla expanded its operations globally, establishing factories in the U.S., China, and Germany, while launching 438 retail locations and 100 service centers worldwide.

Musk has effectively transformed Tesla from merely an automotive manufacturer into a pioneering data technology powerhouse. As of January 2025, Tesla’s market valuation reached an impressive $1.3 trillion, securing its status as the leading automaker in terms of market capitalization.

For those interested in reality TV, keep an eye out for Season 16 of Shark Tank, airing on the ABC network.