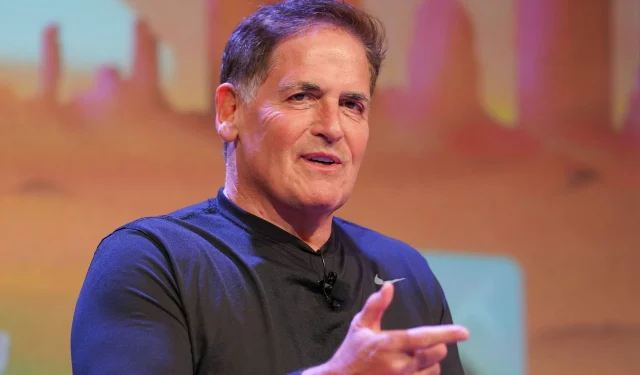

Mark Cuban’s Perspective on Business Loans: A Cautionary Approach

Mark Cuban, renowned investor and entrepreneur known for his role on Shark Tank, has consistently advocated for self-reliance in business ventures. In a notable Bloomberg interview on June 14, 2013, he unequivocally articulated his views on the subject of business loans, insisting:

“First of all, if you’re starting a business and you take out a loan, you’re a moron.”

Cuban’s stance underscores his belief that initiating a business with borrowed capital introduces unnecessary financial risks. He argues that enterprises should be constructed on a foundation of hard work, strategic planning, and an in-depth understanding of the industry rather than relying on debt.

The Risks Associated with Borrowing Money for Startups

Cuban elaborated on why he sees borrowing as detrimental to new entrepreneurs. While business owners are often preoccupied with their operations, lenders are primarily focused on the repayment of loans. He stated:

“There’s so many uncertainties involved with starting a business, yet the one certainty that you’ll have to have is paying back your loan.”

This dichotomy presents a significant challenge, as financial obligations persist regardless of a business’s success or failure. Cuban highlighted that banks and private investors typically do not have a vested interest in the business’s viability, indicating:

“The bank doesn’t care about your business or whoever you borrow from, unless it’s family, doesn’t care about your business.”

In his view, the reality of entrepreneurship demands adaptability and financial freedom—qualities that heavy debt can severely undermine.

Redefining the Myth of Funding as a Success Factor

Contrary to popular belief, Cuban dismisses the notion that insufficient capital is the leading cause of small business failures. He maintains that numerous successful businesses launch with minimal or no funding at all. Cuban asserts:

“99% of small businesses you can start with next to no capital. It’s more about effort.”

Instead of seeking external funding, he encourages entrepreneurs to invest their time in understanding their industry and refining their strategies. Cuban argues that businesses typically fail not due to a lack of financial resources, but due to poor execution and planning. He emphasizes:

“Small businesses don’t fail for lack of capital. They fail for lack of brains, they fail for lack of effort.”

This perspective draws attention to the critical role of persistence, insight, and strategic decision-making in achieving entrepreneurial success.

The Necessity of Hard Work and Industry Awareness

Cuban further elaborated on the significance of dedication in entrepreneurship, noting that many individuals underestimate the effort required to run a successful business. He remarked:

“Most people just aren’t willing to put in the time to work smart.”

He attributed many business failures not to financial constraints but to inadequate preparation and execution. Cuban emphasized the necessity of being well-informed about one’s industry, stating:

“If you start a business, you better know your industry and your company better than anyone in the whole wide world because you’re competing.”

The competition in the business landscape is fierce, and only those willing to commit the requisite hard work and diligence can thrive.

To explore more of Mark Cuban’s insights and experiences, tune into Shark Tank on ABC every Friday at 8 PM ET, with episodes available for streaming on Hulu.