Piper Sandler, a prominent investment banking firm, has unveiled the findings of its latest survey, ‘Taking Stock with Teens,’ now in its 49th installment. This periodic analysis delivers insightful revelations about the spending habits of American teenagers.

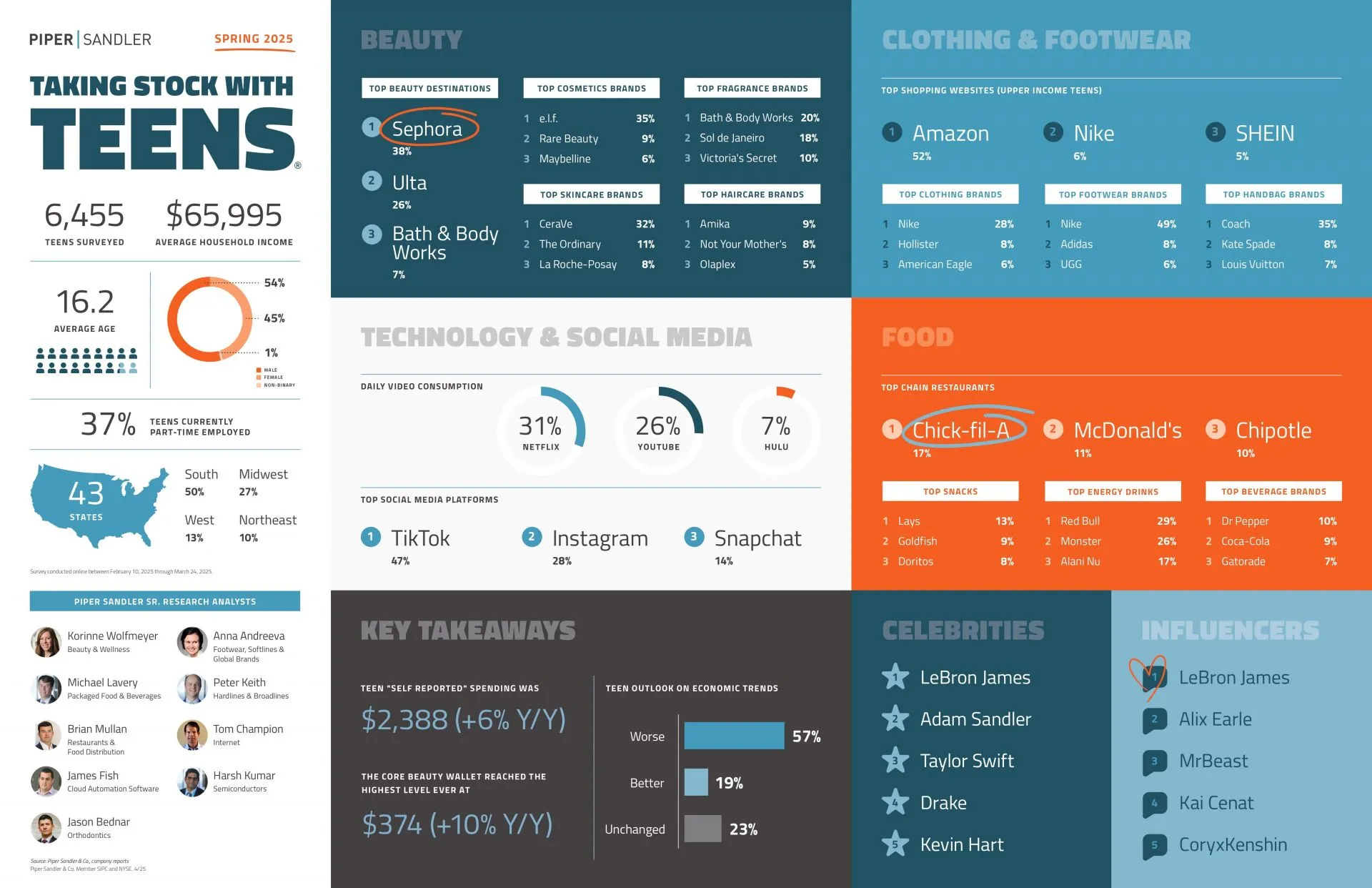

The survey engaged 6,450 teen participants, scrutinizing their expenditures across a diverse array of categories, including apparel, food and beverages, beauty products, technology, and more.

Dr. Pepper Takes the Lead

One of the most surprising outcomes of the survey is Dr. Pepper’s ascendancy within the soda category, overtaking both Coca-Cola and Pepsi. While it’s noteworthy that Dr. Pepper is the most favored soda, it has even surpassed Gatorade in popularity among teenagers.

This upward trajectory for Dr. Pepper is corroborated by a report from Beverage Digest (as cited by CNN), which revealed that the brand has now positioned itself as the second-largest soda brand in the United States as of 2023. The report highlights that Coca-Cola maintains a commanding 19.2% market share by volume, whereas both Dr. Pepper and Pepsi sit at 8.3%. While Dr. Pepper is experiencing growth, Pepsi is trending downward, indicating a significant shift in preferences. Sprite and Diet Coke follow closely with market shares of 8.1% and 7.8%, respectively.

Dr. Pepper, first created in 1885 by Charles Alderton in Waco, Texas, was later marketed starting in 1940. Today, it is produced by Keurig Dr. Pepper in the United States, while internationally, it is manufactured by Coca-Cola in the U.K., Japan, and Korea, and by PepsiCo in Europe.

Key Insights from Piper Sandler’s Survey

The fluctuation in teenage spending is evident, with participants reporting an average expenditure of $2,388, which marks a notable increase when compared to findings from the 2023 and 2024 surveys.

Katherine Wolfmeyer, a research analyst at Piper Sandler, expressed her enthusiasm in a press release, stating:

“Piper Sandler is excited to highlight the results of our spring 2025 Taking Stock With Teens® survey which offers an inside look at how thousands of U.S. teens are spending their money and its correlation to our economy. This spring, teens self-reported annual spending at $2,388, which is an increase from both our spring 2024 and fall 2024 surveys.”

Food & Beverage Preferences

Among beverage choices, Dr. Pepper has emerged as the favorite soda among teenagers, outpacing both Coca-Cola and Gatorade. However, it’s important to note that energy drinks have gained the top spot overall, surpassing traditional coffee and soda options. In the realm of dining, Chick-fil-A secured its position as the most favored fast-food restaurant, followed by McDonald’s and Chipotle Mexican Grill.

Clothing & Footwear Trends

The survey lists Nike as the leading brand in clothing, with Hollister and American Eagle following in popularity. In a significant market shift, UGG has dethroned Lululemon as the reigning fashion trend among wealthier female consumers, a position Lululemon held consistently from 2018 until 2024.

Beauty Favorites

When it comes to cosmetics, e.l.f. Cosmetics has established itself as the premier brand among teenage females. Sephora leads in beauty retail, with Ulta and Bath & Body Works following closely behind.

Technology and Social Media Insights

In terms of social media usage, Instagram continues to dominate, reaching an impressive 87% monthly active user base among teens. TikTok ranks second at 79%, with Snapchat trailing at 72%. For streaming entertainment, Netflix remains the go-to platform for daily video consumption.